Trending Stories

Recommended for You

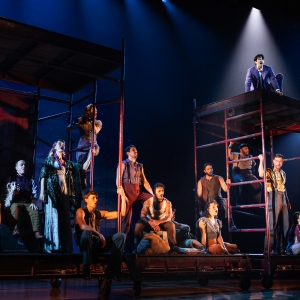

Review Roundup: THE GREAT GATSBY Opens On Broadway

April 25, 2024

Review Roundup: THE HEART OF ROCK AND ROLL Opens On Broadway

April 22, 2024

2024 Drama League Award Nominations Revealed

April 22, 2024

.jpg)