Trending Stories

Recommended for You

THE PICTURE OF DORIAN GRAY Starring Sarah Snook To Hit Broadway in 2025

Snook recently earned an an Olivier Award for Best Actress in a Play for her performance in which she inhabits 26 characters.

Video: Watch Preview of New WICKED Trailer With Jon M. Chu, Ariana Grande & Cynthia Erivo

The new trailer will drop Wednesday.

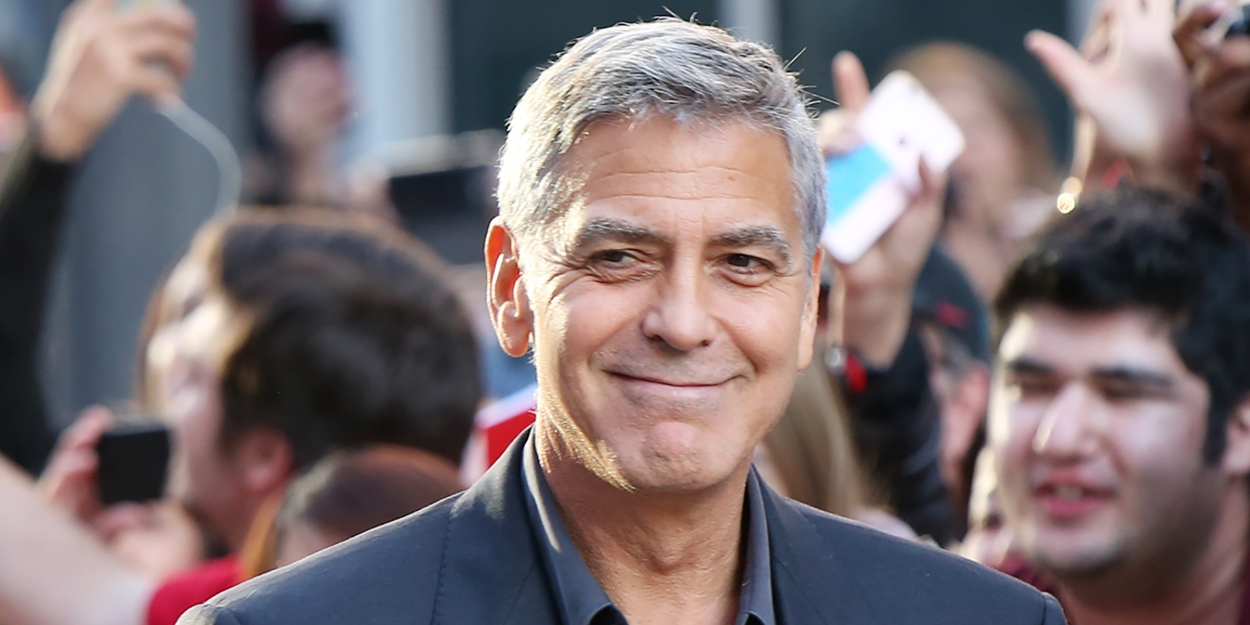

Clooney to Make Broadway Debut in GOOD NIGHT, AND GOOD LUCK

Clooney will star as Edward R. Murrow in the stage adaptation, which will premiere on Broadway in spring 2025.

Photos: APPROPRIATE's Sarah Paulson Receives Portrait at Sardi's

Appropriate is now playing at the Belasco Theatre on Broadway.

West End

Photos: First Look at Tom Holland in ROMEO & JULIET

The production runs until Saturday 3 August 2024

The production runs until Saturday 3 August 2024

New York City

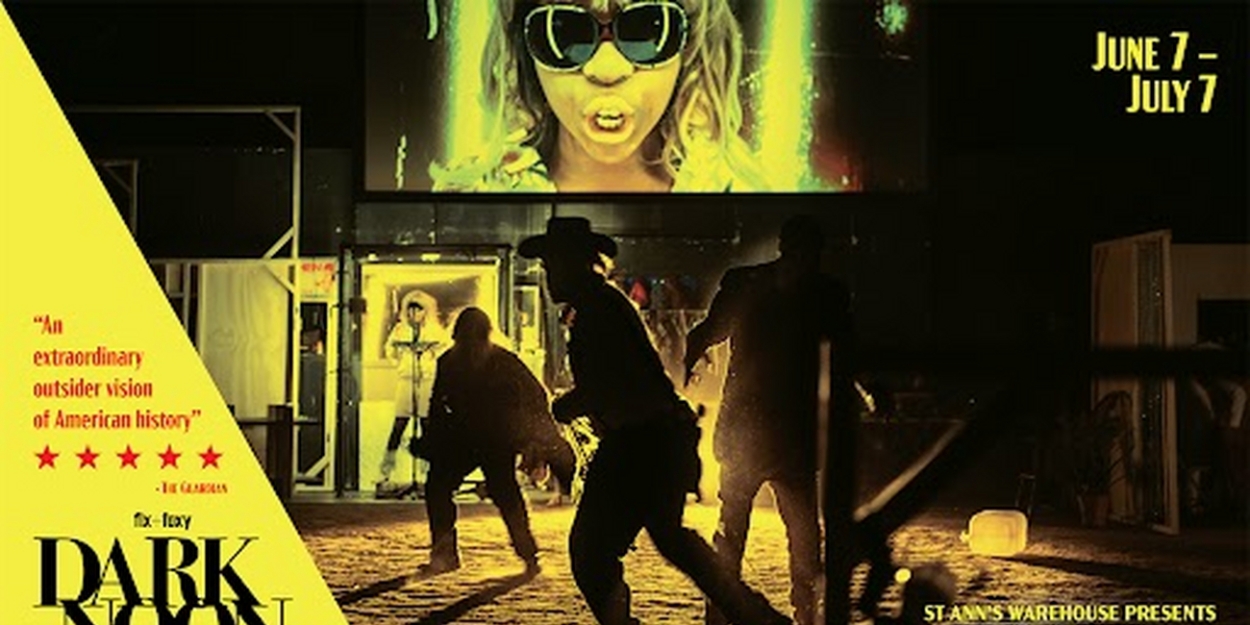

Edinburgh Hit DARK NOON Comes To St. Ann's Warehouse

Dark Noon is a subversive reimagining of the history of the American West through a carnivalesque vision of the genre that glorified it: the Western.

Dark Noon is a subversive reimagining of the history of the American West through a carnivalesque vision of the genre that glorified it: the Western.

United States

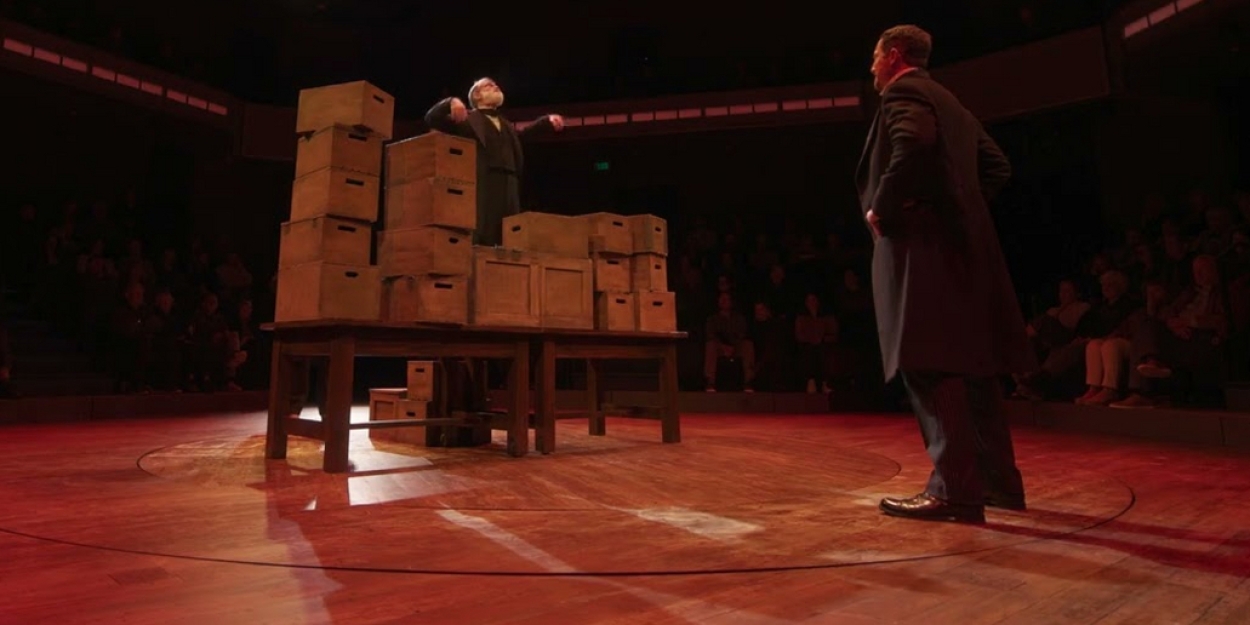

Video: First Look At Denver Center Theatre Company's THE LEHMAN TRILOGY

Now on stage through June 2nd.

Now on stage through June 2nd.

International

Photos: First Look At A SONG OF SONGS London Premiere

The cast is led by the prolific Arab-Israeli actress, writer and composer Ofra Daniel, making her UK stage debut.

The cast is led by the prolific Arab-Israeli actress, writer and composer Ofra Daniel, making her UK stage debut.