Trending Stories

Recommended for You

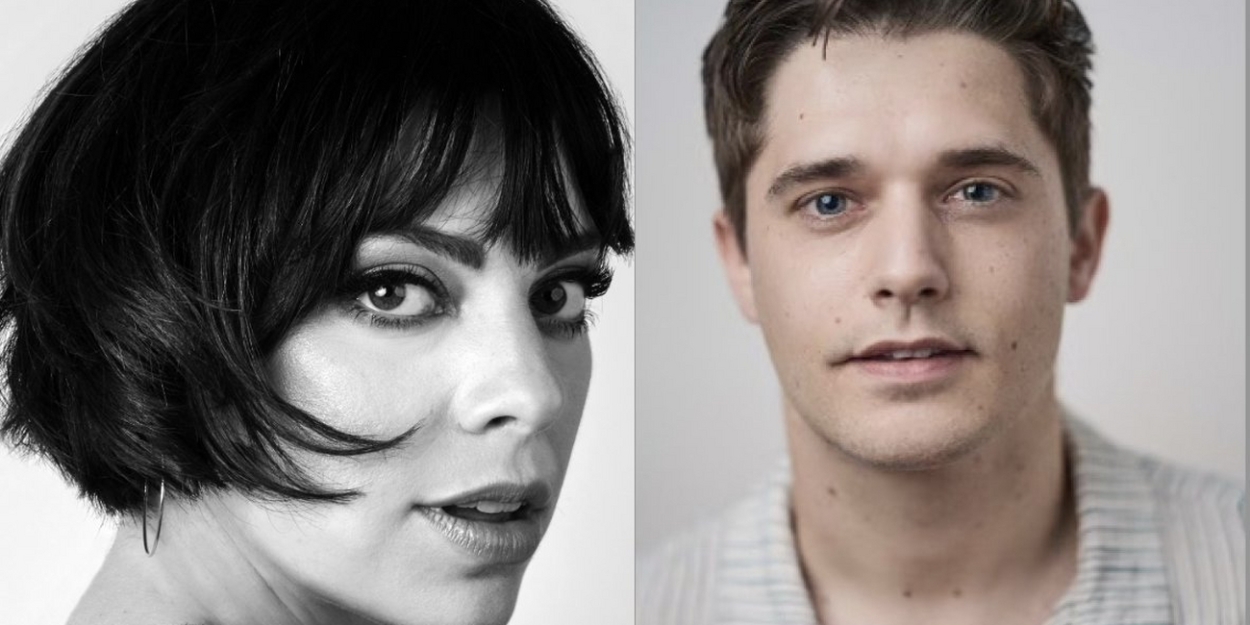

THE PICTURE OF DORIAN GRAY Starring Sarah Snook To Hit Broadway in 2025

Snook recently earned an an Olivier Award for Best Actress in a Play for her performance in which she inhabits 26 characters.

Photos: APPROPRIATE's Sarah Paulson Receives Portrait at Sardi's

Appropriate is now playing at the Belasco Theatre on Broadway.

STEREOPHONIC, SUFFS & More Win Outer Critics Circle Awards

The awards ceremony for the winners will be held on Thursday, May 23, 2024.

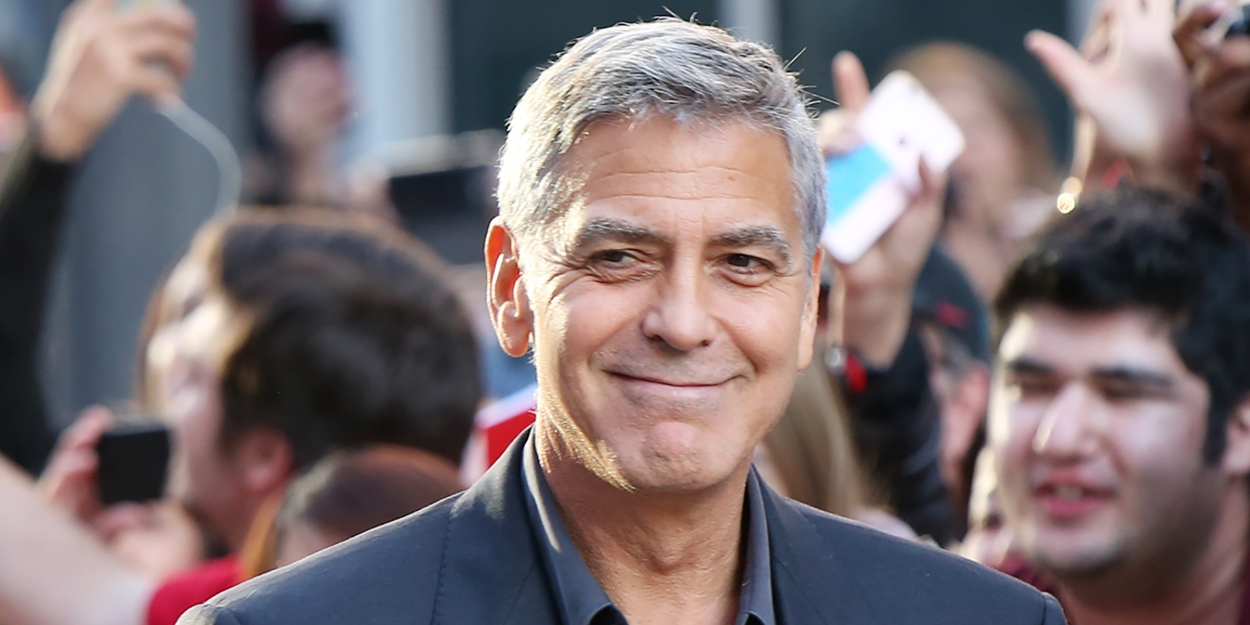

Clooney to Make Broadway Debut in GOOD NIGHT, AND GOOD LUCK

Clooney will star as Edward R. Murrow in the stage adaptation, which will premiere on Broadway in spring 2025.

West End

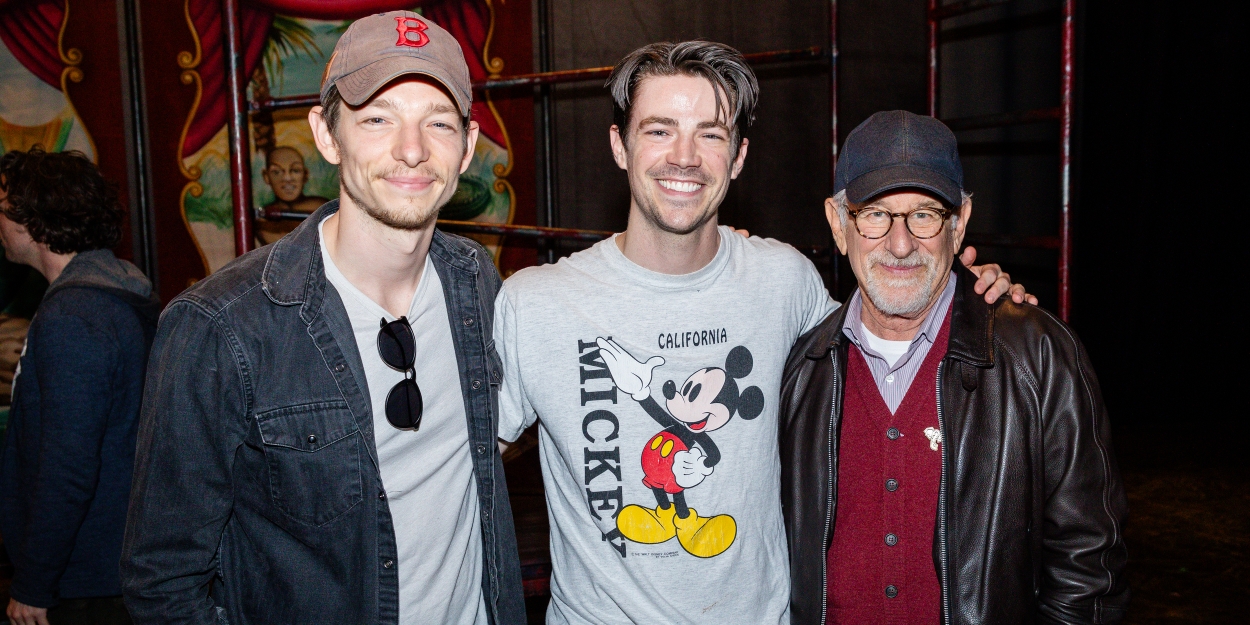

Photos: First Look at Tom Holland in ROMEO & JULIET

The production runs until Saturday 3 August 2024

The production runs until Saturday 3 August 2024

New York City

Review: ONE OF THE GIRLS Is a Springtime Sensation at Chelsea Table + Stage

Kinetic Klea Blackhurst triumphs again, this time with Jerry Herman songs

Kinetic Klea Blackhurst triumphs again, this time with Jerry Herman songs

United States

Video: First Look At Denver Center Theatre Company's THE LEHMAN TRILOGY

Now on stage through June 2nd.

Now on stage through June 2nd.

International

STRICTLY Legends to Reunite For LEGENDS OF THE DANCE FLOOR

Experience the nostalgia of Latin, ballroom, tango, and more in their new show, LEGENDS OF THE DANCE FLOOR.

Experience the nostalgia of Latin, ballroom, tango, and more in their new show, LEGENDS OF THE DANCE FLOOR.