Trending Stories

Recommended for You

SCHMIGADOON! World Premiere, LEGALLY BLONDE & More Set For Kennedy Center 2024/2025 Season

The lineup alos includes The Sound of Music, Parade and more.

Photos: First Look At Pre-Broadway DEATH BECOMES HER in Chicago

The production stars Megan Hilty, Jennifer Simard, Christopher Sieber and more.

THE PICTURE OF DORIAN GRAY Starring Sarah Snook To Hit Broadway in 2025

Snook recently earned an an Olivier Award for Best Actress in a Play for her performance in which she inhabits 26 characters.

Robert Downey Jr. to Make Broadway Debut in Ayad Akhtar's MCNEAL

MCNEAL will begin previews Thursday, September 5, and open on Monday, September 30.

Industry

West End

Review: THE HOUSE PARTY, Chichester Festival Theatre

Sensational re-imagining of Strindberg classic

Sensational re-imagining of Strindberg classic

New York City

Interview: REEVE CARNEY SINGS THE BEATLES at Green Room 42

The Hadestown star will pay tribute to one of his greatest musical influences this Monday at 7 and 9:30 pm

The Hadestown star will pay tribute to one of his greatest musical influences this Monday at 7 and 9:30 pm

United States

Photos: WHAT THE CONSTITUTION MEANS TO ME At Santa Fe Playhouse

What the Constitution Means to Me began performances May 9 and continues through June 2, 2024 on the mainstage.

What the Constitution Means to Me began performances May 9 and continues through June 2, 2024 on the mainstage.

International

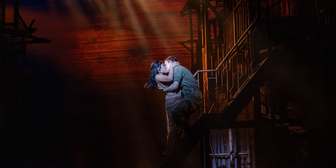

MISS SAIGON Remains Relevant, Given the Continuous Acts of Violence and War Today

‘Miss Saigon’ tours Taiwan and Singapore next.

‘Miss Saigon’ tours Taiwan and Singapore next.