Is Broadway in a Summer Slump?

Of the 12 long running shows, 9 of them have had worse summers than last year.

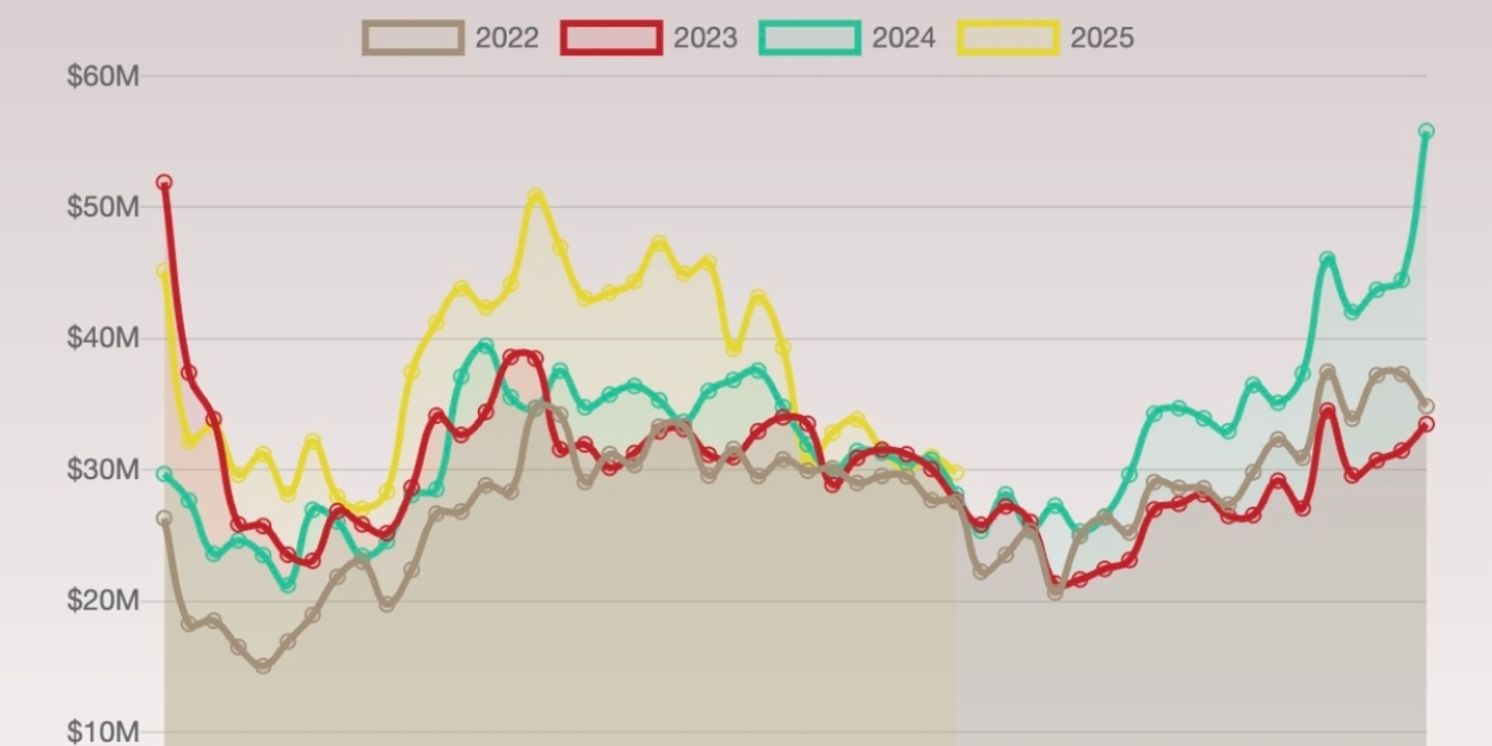

Three months ago, The Broadway League, the consortium of Broadway investors, producers, and theatre owners, announced that Broadway had broken the single season gross record set in the 2018-2019 season. The five weeks that followed seemed to be a continuation of that trend, with the first five weeks of the 2025-2026 season marking the best start of a season in Broadway history. But things have changed since then. Starting on the week ending July 6, 2025, Broadway grosses have stagnated, and have not returned to the highs of the spring and early summer.

Some of the successes of this spring and early summer could be attributed to the high number of star driven revival plays this season (four of them to be exact). But even towards the end of June, after shows such as Othello and Good Night and Good Luck had closed, total gross was still nearly $40 million. No week since the week ending June 29 has been over $35 million in gross, putting the 25/26 summer at only a marginal increase over previous years, with more shows open.

Last week total grosses fell to $29 million across the 29 open shows, this week last season that number was over $30 million across 26 open shows. This included some of the worst weeks in recent memory for long-running shows, as well as poor showings from a lot of newer shows. Shows from this season like Operation Mincemeat had their lowest grossing week of their entire run, including preview period, Buena Vista Social Club too had their worst week since April. Total gross is likely to decrease even further in the coming weeks with Gypsy’s closure. Mamma Mia has been a commercial success so far, and it is anticipated that Beetlejuice will fare similarly, but the current landscape is concerning, especially for new work.

Some of this is the natural cycle of spring/summer highs being sandwiched between fall/winter lows. But that high was much lower than previous highs have been, especially if comparing to pre-pandemic numbers, especially concerning since accounting for inflation that gap is even higher. And fall lows have been much worse in recent years, with how much operating costs have increased, many shows are already at or near their operating cost, another 10% decrease in sales would only plunge them further into the red.

Final tourism numbers for this summer have not come in yet. But of the 12 long running shows, 9 of them had worse summers than last year. The exceptions to that rule are Wicked, which had part one of their movie come out last year and have part two coming out this fall, Hamilton, which is celebrating their 10th anniversary on Broadway with a Tony Awards performance, a new advertising campaign, and a return engagement for Tony Award winner Leslie Odom Jr, and &Juliet, who benefited largely from the celebrity status of Joey Fatone. The two and a half weeks since his departure place &Juliet within the broader trend of long running shows underperforming. This aligns with earlier projections that this summer would see a decrease in international tourism, and other reporting has confirmed these projections, at least anecdotally. There are shows that use the higher grosses of the summer months to offset losses in other parts of the year, and losing that chunk of income would be painful for them.

Last year’s fall featured four original musicals, and two major musical revivals. This year will feature two original musicals, and one major musical revival (as announced so far). Musicals are expensive to produce, and no musical has announced recoupment, new or revival, since &Juliet last year, though Outsiders and Just In Time at least are likely to recoup their initial investment on Broadway in the next few months. Other shows may eventually recoup, but that date is much further down the line. Understandably this has scared off and alienated many investors. If nearly all jukebox musicals are commercial failures, none of the star-led musicals are commercial successes, and original musicals, even ones that win the Tony Award for Best Musical, are taking well over a year to turn a profit, what does one do? Especially given that this is a time of economic uncertainty thanks to a laundry list of baffling decisions being made in Washington DC, upsetting everything in the Broadway ecosystem, from ticket buying practices to investing practices. Even though many investors invest in Broadway shows for not purely financial reasons, few enjoy setting money on fire just to watch it burn. It certainly seems unlikely that we will see numbers like the last two years in the immediate future (29 new musicals have hit Broadway in the last two seasons).

It’s unclear what the fall or next spring will look like commercially, certainly there are shows still coming to Broadway, so the sky is not totally falling right now. Fall is also a time where there are fewer tourists, but more local audiences are attending shows, both within the city and from the tri state area, so it’s possible that there will be a rebound of sorts in the coming months. Even so, every dip in the Broadway financial landscape does breed new opportunities for shows to come in and reset the tides. But those periods are painful and start with many shows closing. The winter of 2008/2009 is often referenced as one of the darker moments in recent Broadway history, when 10 shows closed in a 2 week stretch at the beginning of the year. It doesn’t seem like that’s what we are currently heading towards, or at least not that extreme, but there’s a lot of smoke right now. Let’s hope it doesn’t catch fire.

Videos