Photo Coverage: Senator Charles Schumer Celebrates Federal Tax Breaks for Broadway!

As BroadwayWorld reported last week, there is now an unprecedented amendment to the United States' Federal Tax Code. Due largely to unwavering support from Senator Charles Schumer (D-NY), investors in Live Theatre may now elect to deduct their full investment from their income taxes within the first year of a show's production. What this means for an individual who finances a successful show is that he or she will not be required to pay income tax until the production earns a profit. Under the current Code, only investors in TV and film benefit from this treatment (when capitalization is less than $15 million). For years, Broadway investors have been disadvantaged because their accountants were required to anticipate liability by creatively predicting a show's duration and income, often resulting in tax payments on 'profits' before a producer even earned back his or her initial investment. This was known within the industry as 'phantom income.' Commencing January of 2016, all forms of entertainment media will be treated similarly by the IRS, an amendment the theatre industry has advocated for since 2010.

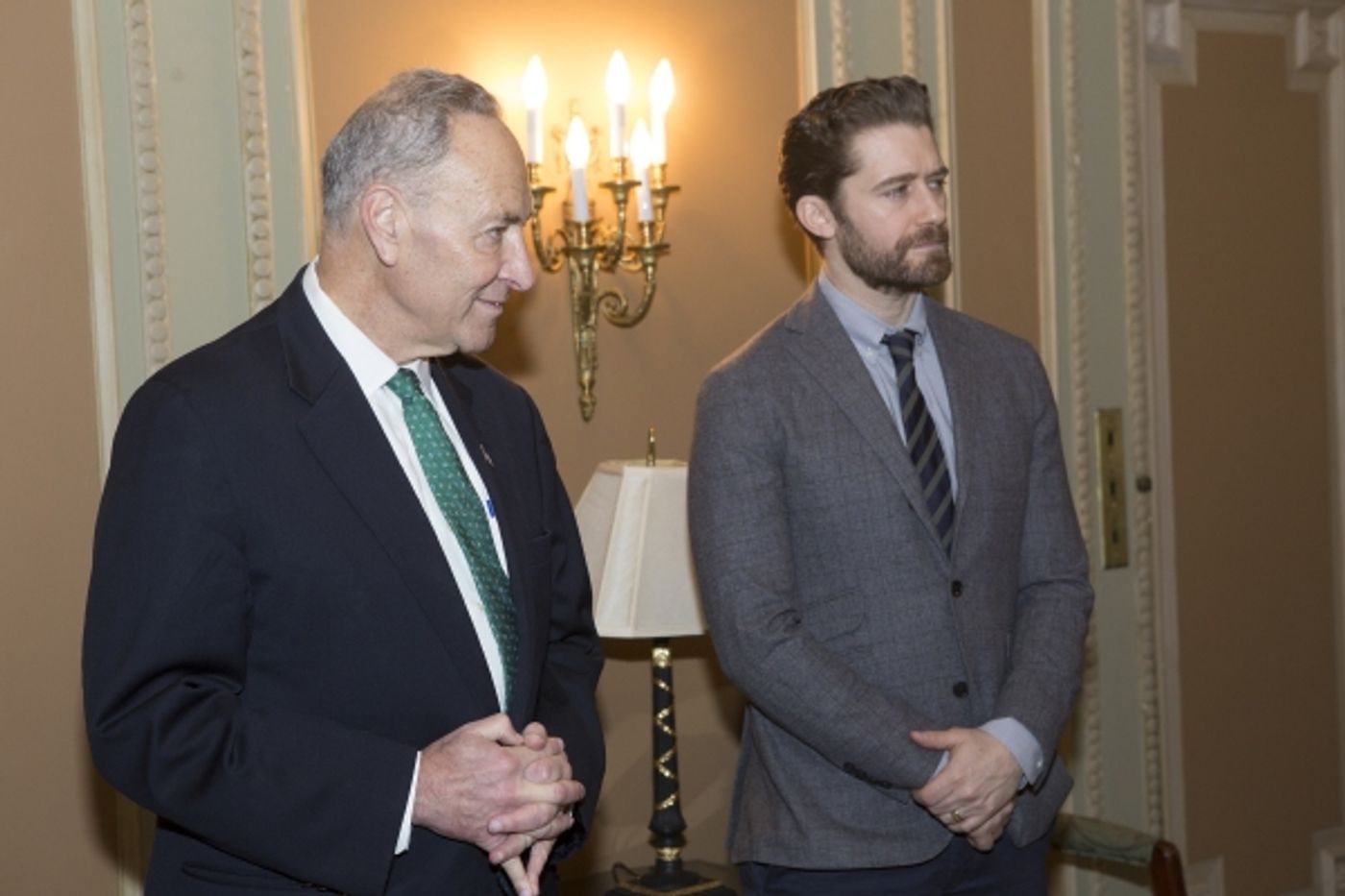

Just yesterday, Schumer joined Robert Wankel (Chairman of the Broadway Theatre League) and some of the Broadway community to commemorate the long sought after federal change. BroadwayWorld's Michael Dale was on hand for the special day, and you can read more about the event HERE. Check out more photos from the big day below!

The concept of including live theatre as a category of entertainment media eligible for this treatment earned bipartisan support in 2013 when Senators Schumer and Roy Blunt (R-MO), as well as Representatives Joseph Crowley (D-NY-14) and Chris Collins (R-NY-27), respectively introduced the Senate's STAGE and House's FILM Acts, which included text that provided the foundation of this Tax Code amendment. While providing a tremendous benefit to theatrical investors, this amendment is expected to be of little-to-no expense to the U.S. as the Congressional Budget Office estimates a cost of just $1 million over a 10 year period.

Photo Credit: Kevin Thomas Garcia

Senator Charles E. Schumer, Matthew Morrison, Robert Wankel, Judith Light and Norm Lewis

Senator Charles E. Schumer and Matthew Morrison

Senator Charles E. Schumer, Matthew Morrison, Harvey Weinstein, Robert Wankel, Judith Light and Norm Lewis

Harvey Weinstein, Robert Wankel, Judith Light and Norm Lewis

Senator Charles E. Schumer, Matthew Morrison, Harvey Weinstein, Robert Wankel, Judith Light and Norm Lewis

Senator Charles E. Schumer

Videos